Why Gold Is the Superman of Elements, French Stocks, and More

There aren’t many substances that don’t break down eventually. Silver, zinc, copper, and iron all happily combine with oxygen and, consequently, rust...

There aren’t many substances that don’t break down eventually. Silver, zinc, copper, and iron all happily combine with oxygen and, consequently, rust...

The Baltic Dry Index (BDI), which is a benchmark of shipping rates around the world, recently hit a four-year high. The BDI tracks shipping of grains, oil seeds, coal and iron ore. These are fundamental components of the global economy—food...

I see proof that a major bull market is coming back in mining, the kind of bull market that can make us rich. The upturn is specific to smaller, leaner concerns—junior mines—which have survived a five-year period from 2011 to 2016, when investors were fleeing the junior mining sector.

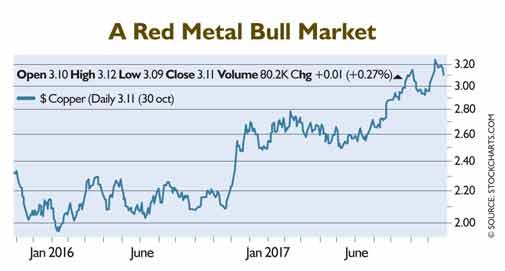

Experts at copper giant Codelco, the Chilean state-owned mining company, believe the red metal could hit $10,000 per metric ton next year. That's $4.55 per pound. It would be a 46% increase from its current price. And that's after copper...

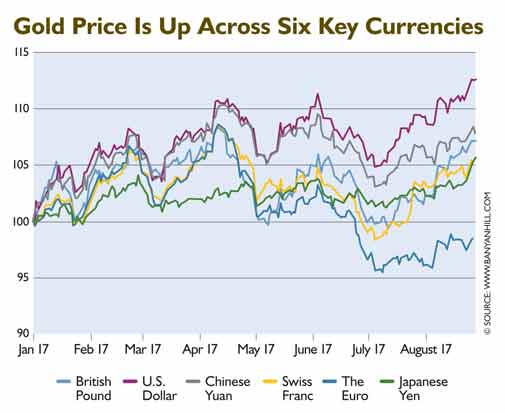

The gold price is a complicated beast. It’s like a seesaw, with gold sitting on one seat. But instead of one seat across from it, there are several, because each country has its own currency. Those currencies go up and down against each other. Years ago, a brilliant analyst found that you couldn’t use any single currency to figure out bull or bear markets for gold.