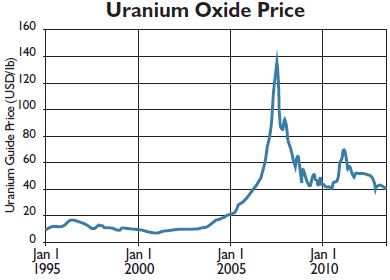

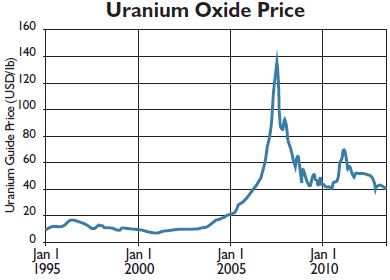

Uranium: “Either the Price Goes Up or the Lights Go Out”

On March 11, 2011, a magnitude 9.0 undersea, mega-thrust earthquake became the greatest ever to hit Japan. Minutes later another unforeseen event struck: a giant tsunami.

On March 11, 2011, a magnitude 9.0 undersea, mega-thrust earthquake became the greatest ever to hit Japan. Minutes later another unforeseen event struck: a giant tsunami.

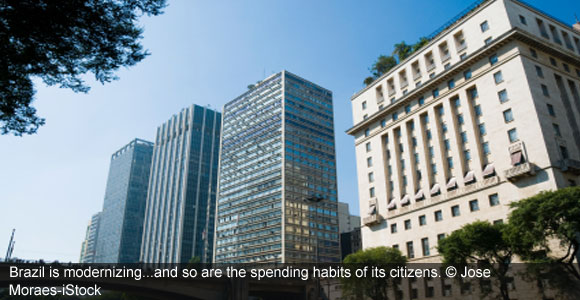

There’s something strange going on in Brazil. You might call it a “schizophrenic economy.” Brazil is an economy of two halves. From the outside looking in, it’s a former star player plagued by socialist leaders with no understanding of free-market principles. But from the inside looking out, it’s a booming emerging market with record low jobless numbers, a strong currency, and high interest rates to keep the economy from overheating.

It had to happen sometime. After a decade of outperforming U.S. stocks, Brazil has started lagging behind the States. Now, I have recommended Brazil a number of times in these pages. So in true IL fashion, I hopped on a flight to São Paulo to put “boots on the ground.”

Norway is uniquely placed to protect wealth. It is outside the euro zone, has low public debt, ultra-low unemployment, and a strong and stable currency. It also has the world’s largest sovereign wealth fund…with a staggering $664 billion under management. Think of Norway as the Saudi Arabia of Europe.

Banksters…fat cats…one-percenters… there’s no shortage of put-downs for bankers these days. But not all bankers are evil. And not all banks are created equal. One bank that stands apart is Panama-headquartered Banco Latinoamericano de Comercio Exterior S.A.—or Bladex, as it is more commonly known.

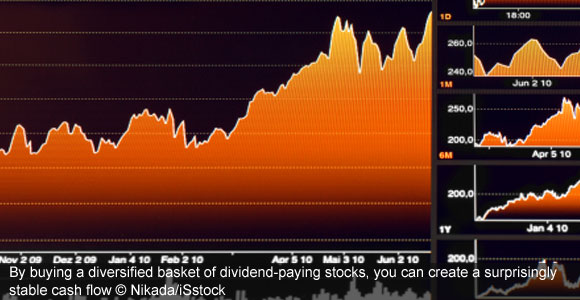

One of the best ways to create cash flow right now is through stock dividends—especially through stocks with exposure to the emerging markets. Cash flow is the amount of money your portfolio “pays you” each year. And by buying a diversified basket of dividendpaying stocks, it can be surprisingly stable.

If you want to see real economic growth, get a taxi through Hanoi at rush hour. Every day, millions of residents of the Vietnamese capital weave their way through the city on newly-bought Chinese and Japanese motorbikes and scooters. Twenty years ago, bicycles were the main form of transport.

The case for investing in Mexico has never been so compelling. And there are four important factors why. First, the Mexican government is planning to introduce important pro-market reforms under newly-elected president Enrique Peña Nieto of the Institutional Revolutionary Party, who takes office next year. He is supported in these reforms by the opposition, center-right National Action Party.

The best time to buy stocks and other assets is when investors are running scared. I’ve been banging this drum all year—especially when it comes to Europe. I believe the crisis there is about to throw up a genuinely once-in-a-lifetime buying opportunity for contrarian investors.

Let me warn you up front: You probably won’t like today’s recommendation. It has nothing to do with the stock market. Today, I am going to recommend that you dip your toe into a different market—and buy bonds. I bet not one in 100 readers of this magazine gives the bond market as much attention as he gives to the stock market. And it’s fashionable these days to talk about all bonds as “bad” investments.