No doubt that now is a challenging moment to think about buying stocks—especially those overseas. The coronavirus has stirred global panic and will likely slow the world economy, particularly the two primary engines of growth: the U.S. and China.

But like all crises, this, too, shall pass.

I don’t write that to be dismissive or flippant—only to note, instead, that past, similar crises have ultimately abated and that a rebound has ensued. But here’s the caveat: The rebound this time will look different than what we saw before the fall.

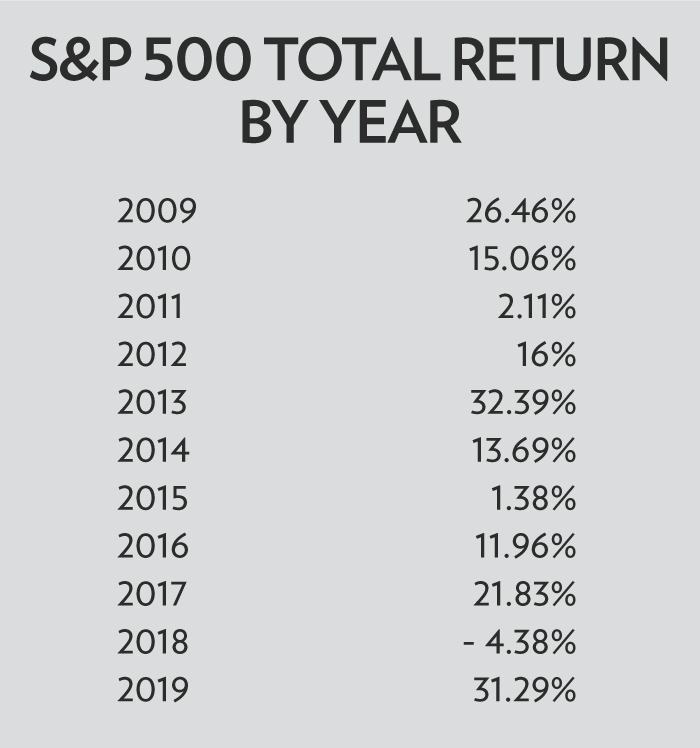

In the 11 years since the end of the global financial crisis, the S&P 500 has racked up 10 winning years against one down year. And the total return…well, phenomenal seems to be about the only adjective that fits. Every $1 invested in the S&P 500 on January 1, 2009, grew to $4.50 by the end of 2019. That’s an annualized return of nearly 15%—roughly double the S&P’s historic, yearly average.

When you see the annual return stacked up by year, the numbers are just amazing. Take a look at the chart below.

Alas, trees never grow to the sky. Or, put more bluntly: This cannot continue much longer.

Well, technically, it can. Entire markets and individual stocks can stay irrational for far longer than a bearish investor can stay solvent. But at some point, the party always ends.

Already, worrying signs are beginning to percolate in the U.S. economy signaling that Wall Street is reaching “last call.” To wit:

• Payroll growth has been slowing for much of the past year.

• The U.S. economy, though growing, is growing barely fast enough to generate the jobs necessary to keep unemployment from ticking higher.

• The jobs the economy is creating, despite low unemployment, are largely low-wage, low-skill service-sector jobs that don’t foster middle-class expansion.

• Consumer confidence, though still high, has been trending down since the summer and has fallen nearly 10 percentage points.

• The Purchasing Managers’ Index, gauging manufacturing trends, is contracting faster than expected and registered a reading in December that marked its lowest level since just after the Great Recession.

• Trade wars are hitting U.S. farmers and manufacturers, and manufacturers in turn have been laying off skilled workers who were earning middle-class wages.

• Tax cuts that promised to boost the economy largely did not, according to the government’s own research. Instead, they simply exploded U.S. debts and deficits which, at some point, are likely to drag down the U.S. dollar (and we will come back to this in a moment).

Of course, in our post-truth era, such facts are but a minor inconvenience that Wall Street chooses to largely ignore. The market is so punch-drunk on a decade of outsized profits that any warning sign means about as much as a stop sign does to a drunkard on the way home from a week-long bender.

At the moment, the S&P 500 is trading at nearly 25 times the combined profits earned by the constituent companies inside the index—the so-called price/ earnings (PE) ratio. Historically, the S&P trades at a PE of just under 15. (The PE ratio essentially measures how much an investor is willing to pay to own a dollar’s worth of corporate earnings. When investors are giddy, as they are today, they eagerly overpay. When investors are feeling frumpy and fearful, they too often underpay, as they did in the early 1980s when, amid the depths of investor disinterest in stocks, the S&P PE ratio was about seven.)

More worrisome is something called the Shiller PE, which smooths the economic cycles over a 10-year period to come up with an inflation-adjusted PE ratio that is a more accurate measure of over-, under-, and fair valuation than is a static snapshot of the current moment. Today, the U.S. market’s Shiller PE is 31, marking the U.S. as one the priciest stock markets in the world. Historically, the U.S. Shiller PE is about 16.

All of this says that the U.S. stock market is overvalued, long in the tooth, and likely primed for a decline—either because the economy keels over or, possibly, because of some exogenous shock (like the coronavirus scare.)

If nothing else, the data simply confirm that U.S. stocks are so richly valued that they need to take a breather so that earnings can catch up with valuation. And if that’s the case, then we’re going to see institutional investors (mutual funds, pension funds, and such) rotate out of U.S. stocks and into foreign stocks.

For us, the individual investor, it’s time to go global with some of our greenbacks.

To be sure, many markets around the world are, like Wall Street, oxygen deprived these days. Ireland is expensive, as is Denmark, the Netherlands, Switzerland, and New Zealand. In fact, the world as a whole carries a traditional PE ratio of 19 and a Shiller PE of 24. That’s not crazy expensive like America, but it’s decidedly not cheap and is, arguably, somewhat overvalued.

That said, market averages are always comprised of stocks and markets that are expensive and those that are cheap…and cheap, or at least relatively cheap, stock markets do exist around the world.

Take, for instance, the United Kingdom.

The U.K. certainly has Brexit-tainted political headwinds that could morph into substantial financial headwinds in 2020, depending on how that drama plays out. That said, the U.K. is relatively inexpensive with a traditional and a Shiller PE both in the 16 range. Nearby Spain is even cheaper. Poland and the Czech Republic are cheaper still, sporting traditional and Shiller PEs in the range of 10 to 13.

And it’s not just Europe that’s on sale. Over in Asia, Hong Kong, China, Singapore, and Malaysia are all in the stock market equivalent of the bargain basement bin at the moment.

As for the absolute cheapest: Russia and Turkey, each with single-digit PE ratios, are the least-expensive major markets in the world. Yes—they both have financial and/or political issues they’re dealing with. But such events are usually fleeting, and market valuations always revert to the mean.

Said another way: What goes up, always comes down…and what’s currently down regularly goes back up.

And in that is our opportunity to profit. The way we do so is to take profits in what has gone up (the U.S.) and invest in what is currently down (much of the rest of the world).

Here is where I’m looking.

First and Foremost: Emerging Europe

I would certainly have a mutual fund or exchange traded fund (ETF) that singularly invests in this part of the world, which includes Russia, Poland, Czech Republic, Hungary, Greece, and Turkey, among other markets. This is the cheapest part of the world today.

That’s largely because institutional investors are currently focused on major European markets such as Germany, Switzerland, France, the Netherlands, etc. “Big” and “blue chip” are in vogue because these kinds of large stock markets are where most of the world’s liquidity resides.

Smaller markets, even though their economies are growing nicely in many cases, are simply shunted aside for lack of interest due, in part, to lack of liquidity. (Big investors like to be able to get into a market without their large-scale purchases moving a stock price; and, more importantly, they like to be able to sell their positions quickly, if they need to flee in a crisis).

Second: Asia

I would own a mutual fund or an ETF that owns just China, one that invests just in Hong Kong, and a third concentrated on Southeast Asia.

China and Hong Kong are cheap. Hong Kong, in particular, is artificially cheap because of all the social unrest rocking the city in recent months. That will pass, and Hong Kong markets will right themselves quickly.

Though not every market in Southeast Asia is cheap, most of the funds that you will find have a large concentration in Singapore and Malaysia, and both of those markets are relatively cheap and stacked with strong companies.

Third: The United Kingdom

Brexit is a wildcard, no doubt. And I am not convinced conservative British politicians are smart enough to navigate this without disaster. Nor is much of the world impressed with the loony lurch away from the European Union, as witnessed by the fact that U.K. stocks have pretty much trodden water for the last few years.

Still, the U.K. is cheap, and it’s loaded with some of the world’s bluest blue chips. It’s worthy of a small investment at these levels.

Finally, let me address the issue of currency. You absolutely want to find mutual funds and ETFs that do not hedge their currency exposure, meaning that they don’t seek to negate in dollar terms the impact of currency movements on the portfolio.

As I noted above, U.S. debts and deficits are, ultimately, untenable. And the White House is constantly berating the Federal Reserve for ever-lower interest rates, while imprudently racking up ever higher debts and deficits. That speaks to a weakening dollar at some point in the not-too-distant future.

As the dollar declines, the value of other currencies rises by definition. In practical terms, that means that if a British stock is trading at say, £10, then right now it is worth $13.10. But if the dollar fell, say, 10% against the pound, that same British stock trading at the same £10 price, is suddenly worth $14.53. You made a nearly 11% gain even though the stock’s price didn’t move.

It’s a win-win as you rack up profits and dividends.

Better still is that any dividends you earn from the stock, ETF, or mutual fund will buy increasing amounts of dollars back home. It’s win-win as you rack up profits and dividends.

So, while U.S. stocks are still trading at nosebleed levels, take a moment to lock-in some of those profits, and then look to invest them to work in far cheaper markets around the world.